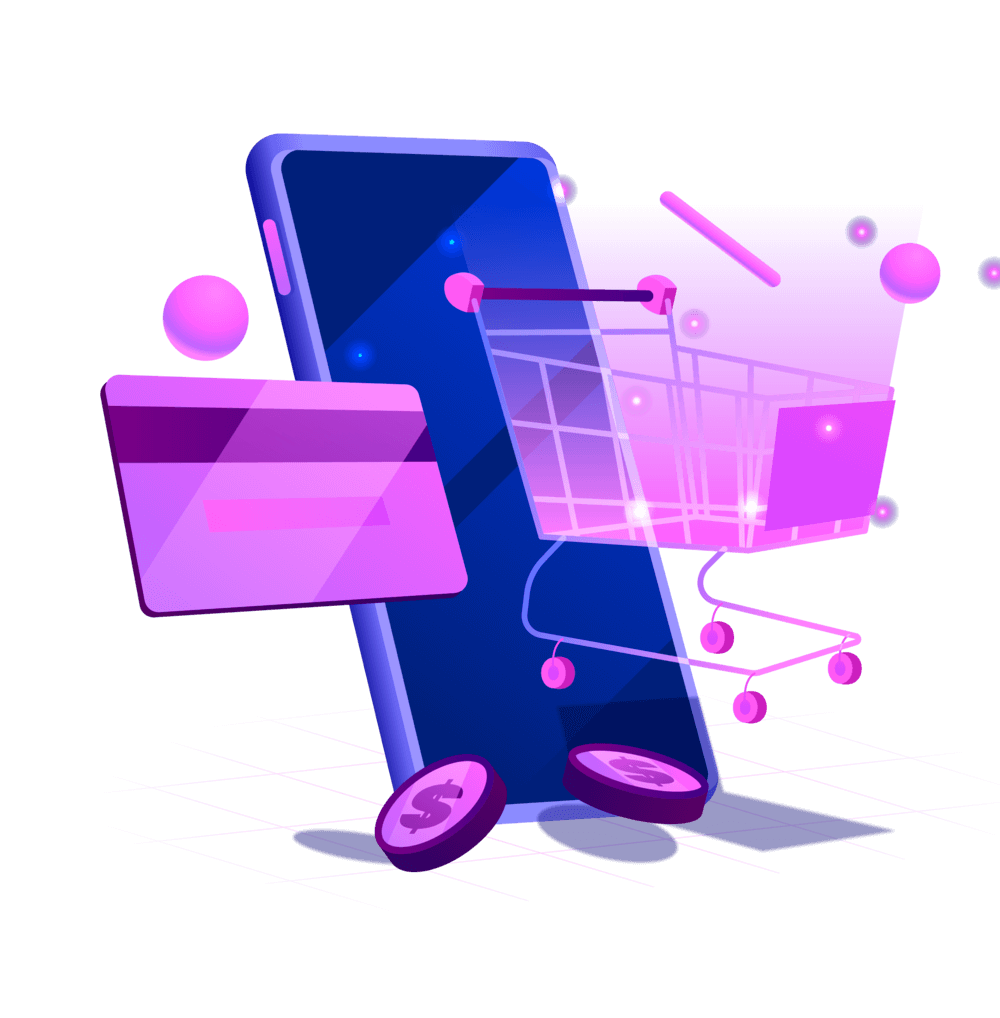

If Marc Andreessen is famous for saying “Software is eating the world,” then now, Aggregators are “eating” the E-commerce world. Indeed, the hotness of this model is undeniable as the total capital of businesses in the past 12 months has increased more than 20 times thanks to e-com aggregators. From 460 million USD in September 2020 to more than 9.8 billion USD in September 2021. What an impressive figure!

In the previous article, GCT Solution briefly introduced the eCommerce aggregator and its use cases. To help you better understand this term, in this blog, we will provide an in-depth analysis of eCommerce aggregator under Thrasio’s case study.

1. Thrasio - History of Foundation

Carlos Cashman founded Thrasio after running OrionCKB, a Facebook marketing agency. Orion, founded in 2013, has many consumers due to their Facebook and Instagram customer acquisition campaign. Ecommerce is a minority in his campaign.

Carlos watches Orion's marketing results of these brands. He said:

"Our customers expanded at $50-100 million while we received monthly payments. Whatever they're paying us is fine, but it's still just a monthly fix. This prompted me to investigate Ecommerce prospects."

Every day, Orion receives a lead from a Shopify or WooCommerce DTC brand with a 20-25% margin. Carlos and the team must reject these customers because Orion only accepts customers that spend $50,000/month.

Orion rejects these customers but keeps getting leads. This is when Carlos confides in Josh Silberstein, his Thrasio cofounder.

Carlos: I've looked at these kinds of businesses, and I believe I could take it from $2 million to $10 million or $20 million if I controlled it.

Josh: Let's say we buy a business. To scale it, we can spend $50-100k on advertisements they don't dare to spend on. It's a test, so if it works, terrific, but if it fails, the firm is still producing money to cover the ads budget. Sell it if we're bored, we're still even.

Carlos and Josh said: What if we raised finance, bought all these businesses, and scaled them using the Orion team's Marketing Performance strengths?

This is the first concept that shaped Thrasio's future.

First, Carlos and Josh searched for e-commerce brands to buy. However, Asynchrony between brands is a concern. These websites use diverse platforms like Shopify, WooCommerce, BigCommerce, and Magento. Regarding operation, they use different 3rd Party Logistics, and ship different products. Acquisitions and scaling them need a massive effort to operate properly.

Then, team Thrasio met Casey Gauss, founder of Viral Launch, a platform where new Amazon FBA sellers could learn everything. After months of mentoring by Casey, one day, Josh went back to team Thrasio and said: "Forget all the brands e-commerce in the same sector, why don't we simply start with the business with the same operating synchronization as Amazon FBA"

So said so done, Thrasio starts looking for the first brand. They googled and found multiple brokers selling various businesses, including Amazon FBA businesses. Carlos and Josh acquire a business determinately. It's a brand of battery-powered handheld mixers that can make tea, coffee, or egg whisks. After the acquisition and rebranding to Frothy, Thrasio's sales increased to several hundred thousand USD each year.

2. Thrasio Business Models: How Did Carlos and His Team Operate Their Business?

A. Financing deals

Before buying businesses, Thrasio needs money. Thrasio uses debt to buy Amazon brands like a private equity company employing LBO.

Regarding LBO (leveraged buyout), it is a business that PE firms often use to buy a business. Since M&A transactions are expensive, they often borrow from the bank.

For example - Blackstone wants to spend $1 billion on business A. They'll spend 200 million in cash and borrow 800 million from the bank.

When the bank approves, Blackstone will take that business A and its assets after the purchase as collateral for this loan.

After four years, Blackstone sells business A at $2 billion. Blackstone received $1.2 billion—6x the initial 200 million capital—after paying the bank 800 million. This is a better use of cash than without an LBO, but you have to pay a billion to buy the business and only get 2x your investment.

Likewise, Thrasio and other Ecommerce Aggregators also need financing to buy business e-commerce. Ecommerce Aggregators now have approximately 45% debt, according to Harbeck. Aggregators averaged per deal.

In fact, nearly half of the brand's purchase price was borrowed.

Aggregator financing has two basic causes.

- First, buying a firm is expensive. If they exclusively buy using equity funds, they will have to call a lot of money, diluting the shares quickly. With Thrasio closing more than one business per week and using all equity cash to buy, founders only control a few percent of the shares after a few years.

- Second, this model has shown its effectiveness. This lets Aggregators quickly call in so much debt financing. Thrasio has always made money, unlike other fast-growing startups. That makes sense—the aggregate of many profitable enterprises must be lucrative).

B. Sourcing deals

After having money, the next step in Thrasio's cycle is to find the right Amazon FBA business to buy. Ken Kubec, VP of Acquisition shares the criteria Thrasio seeks when looking at an Amazon FBA business.

3R - Review, Ranking & Rating

At first, they looked for brands that are category leaders, and always ranked in the top of the search with a coefficient of 3R - Review, Ranking, and high rating.

Initially team Thrasio tried to buy brands with lower rankings - at the bottom of page 1 or the top of page 2 of the search results to try to push these brands to the top. However, after a hard time, the team realized that this was much harder than they could imagine. The reason is that the feedback loop mechanism when the products in the top results will be easier to buy => more reviews => easy to attract new buyers, and so on. Of course, you can break this loop but you'll have to spend a lot of money in the beginning.

The more logical tactic that Thrasio is now applying is to buy the brand already at the top and take advantage of the inherent marketing to scale it to higher thresholds. According to Ken, the most profitable deals so far for Thrasio are products with extremely good "social proof" with 10-20,000 turns.

Since then, Thrasio uses a range of rebranding, marketing, and supply chain optimization solutions to raise the revenue level for the brand.

Category

Thrasio does not limit business buying to a specific area, as long as they see potential growth. However, there are two areas Thrasio often avoids: fashion and food.

The reason is that fashion products are often very seasonal. This type of product is almost extremely difficult to maintain the top position in search results for a long time because of the competition for new products and constant changes in the tastes of users. Food is so obvious, everything related to food has higher requirements for transportation and storage than other products.

A good example given by team Thrasio to describe the type of product they love is the spatula. These kinds of products are used every day, all year round, all month long, with constant demand, and are available everywhere in the world. These help brands on top of search results have a stable revenue source for a long time.

In addition, these products have very little difference between brands, so the leading advantage - the defensibility of the brands in the top search in these categories is much better than the top brands in other categories, especially compared to goods such as fashion. For example, you may not buy a coat on the first page of the search results because the pattern and color are not correct, but when buying a rice sausage spoon with 20 almost identical results, it is very likely that you will buy from the store with the most stars and reviews on the top.

Not only that, these products also have the plus point of being easy to store and not worrying about the risk of failure during the whole transportation process.

Online Only

Another question that Team Thrasio often asks when reviewing a product is - where else would you go to find this? - Can you buy it somewhere else?

They look for products that are very difficult for users to find on offline channels.

According to Ken, there is a trend today that more and more products are being lost from traditional sales channels. “Where would you buy a dart board?” Ken took the example. These products have in common the absence of large AOVs, low frequency of purchases, and low-profit margins. These make them unsuitable for shelving in offline sales channels and must be gradually switched to online channels.

Room to Grow

Finally, it is even more important that team Thrasio assess whether to buy a brand or not than the potential for further growth. If a business has met all the above criteria but has been well optimized and not much potential for Thrasio to scale up more ( about 150% a year), they will not buy those brands either.

Conversely, if your brand is growing extremely well on Amazon in the US while still not launching on Amazon in other countries, this is a very good signal for Thrasio to buy and scale to other markets.

C. Closing Deals

After finding the right business, Thrasio will work with the brand owner. This is when Thrasio looks at the brand's books, business results, and supply chain... to make appropriate pricing.

Valuation metrics

Thrasio does not detail the points they use to make a valuation, however, Hahnbeck, an M&A consultancy firm working with many Amazon FBA aggregators, reveals that the following points are often taken into account:

1. Size - The bigger the revenue.

2. Net margin - the higher the profit margin, the better.

3. Growth - rapid and stable growth.

4. Take the top spot in organic searches on Amazon - extremely important.

5. Secured Intellectual Property - If the brand has a patent, trademark, trademark registration — or maybe an exclusive manufacturer, it will be a huge plus.

6. Relatively few SKUs - this makes it easier to take over and operate (Business has $1 million in sales with only 5 products that are much more attractive than business with $1 million in sales but 100 products).

7. Amazon Turnover Rate - If 90% of your revenue comes from Amazon, then there will be more Aggregators wanting to buy you back than 50% of your revenue comes from Amazon. (This is gradually changing as more and more cross-platform aggregators and ready to buy your brand regardless of where your revenue comes from).

Valuation Multiples & Deal Structure

Each business has a different valuation based on the criteria above, however, most of Thrasio's deals are usually "closed" at 2-3 times EBITDA (profit before tax, interest and depreciation), plus a portion of profit within 2 years later if the business is well scaled up.

For example - there is an Amazon business with a pre-tax profit of about $1 million per year. To buy it back, Thrasio will pay the owner between $2 and $3 million in cash immediately. In addition, if Thrasio increases its profits to 2.5 million in the following year after the acquisition, Thrasio may pay the brand owner up to 50% of the increased profit - i.e. 50%*( 2.5-1) = 750k USD in this case.

Depending on the desire for upfront cash vs future earnout of each brand owner, Thrasio will offer the deal structure with the corresponding rate to satisfy their needs.

With the experience of valuing thousands of eCommerce businesses in the past, Thrasio is increasingly perfecting its buying and selling cycle. This is shown by their really dizzying pace of “going to the market” all this time. For more than three years after its founding, Thrasio has bought more than 200 brands, which means that on average they buy more than one new brand every week.

Final thoughts

Most startups have founders that have very deep thinking on product and distribution to take the startup from zero to one and then scale up. Thrasio, on the other hand, demonstrates how an Operator-led startup will operate. They don't have a single product; instead, they develop an operating machine, a cycle to optimize and scale everything that goes into it. With Ecommerce expected to grow much more in the coming years, Thrasio and Aggregators worldwide are likely just getting started.

If you are seeking a seasoned IT provider, GCT Solution is the ideal choice. With 3 years of expertise, we specialize in Mobile App , Web App, System Development, Blockchain Development and Testing Services. Our 100+ skilled IT consultants and developers can handle projects of any size. Having successfully delivered over 50+ solutions to clients worldwide, we are dedicated to supporting your goals. Reach out to us for a detailed discussion, confident that GCT Solution is poised to meet all your IT needs with tailored, efficient solutions.